The Dow surged 669 points on Monday after trade tensions eased, erasing the drops from last week.

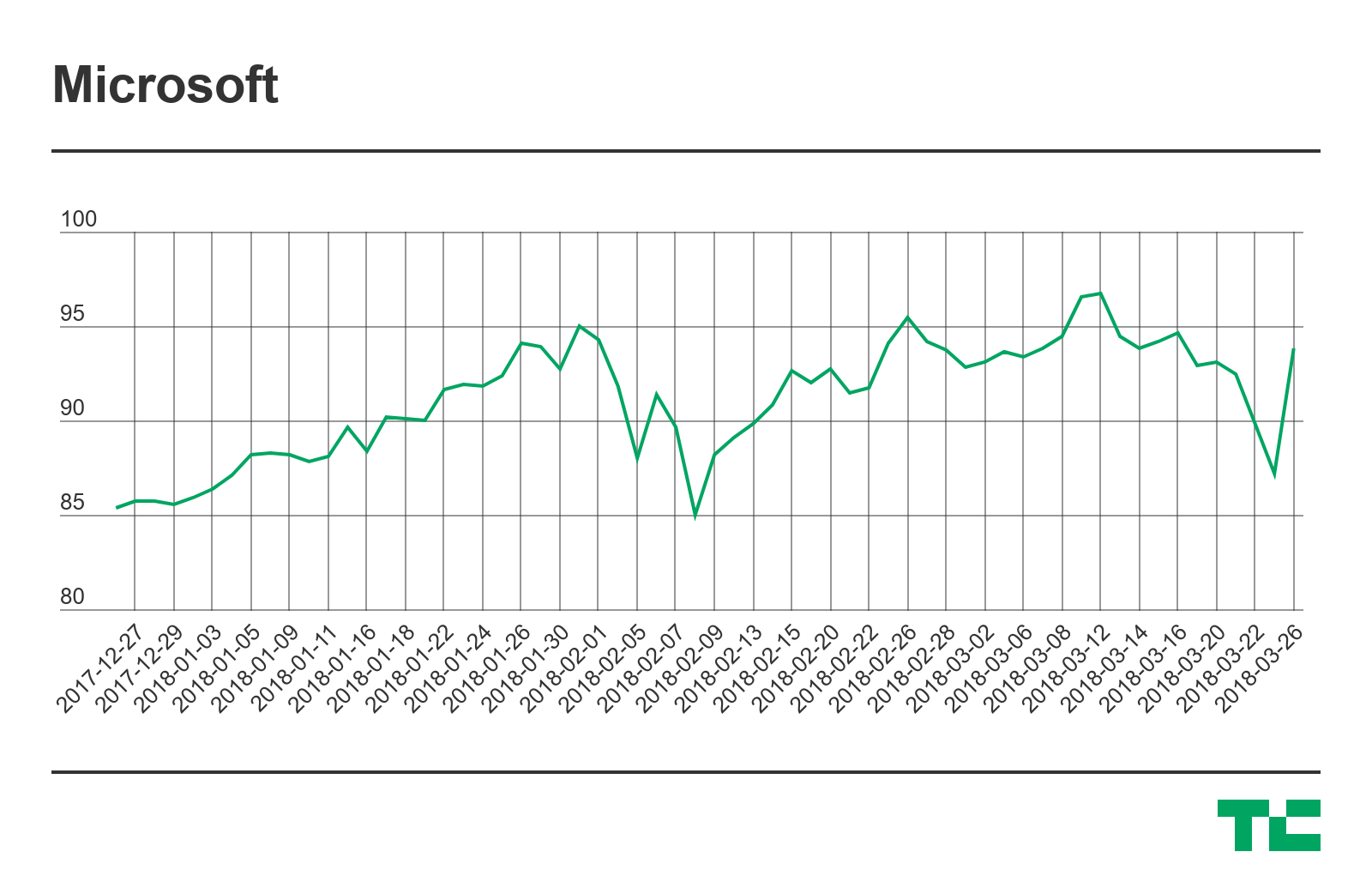

Tech stocks like Amazon and Apple saw gains, but the biggest winner of all was Microsoft. The company closed the day at $93.78, up 7.57%.

The Seattle tech giant, which is a Dow 30 company, benefitted not only from the solid stock market day, but also because a Morgan Stanley analyst had kind things to say about it.

Keith Weiss wrote in a note to clients that he’s raising his 12-month price target to $130, an almost 50% increase from the $87 shares traded at last week. This would give the company a market cap of $1 trillion.

He’s particularly bullish on Microsoft Azure, the company’s cloud business. He believes that it will continue to do well and improve its margins, despite competition from Amazon and Google.

“With Public Cloud adoption expected to grow from 21% of workloads today to 44% in the next three years, Microsoft looks poised to maintain a dominant position in a public cloud market we expect to more than double in size to (more than) $250 billion dollars,” Weiss wrote.

He also likes the Office 365 software. Weiss said he’s expected double-digit gross profit dollar growth in this category for the next five years.

In general, stocks have done very well in recent years, with the Dow up nearly 10,000 points from where it was five years ago.

Microsoft is up 44% in the past year alone.

The company has done particularly well since Satya Nadella took the helm in February 2014. He’s Microsoft’s third CEO, coming after Bill Gates and then Steve Ballmer.

from TechCrunch https://ift.tt/2pGtfeN

No comments:

Post a Comment